Wasted Time

Investment Opportunit

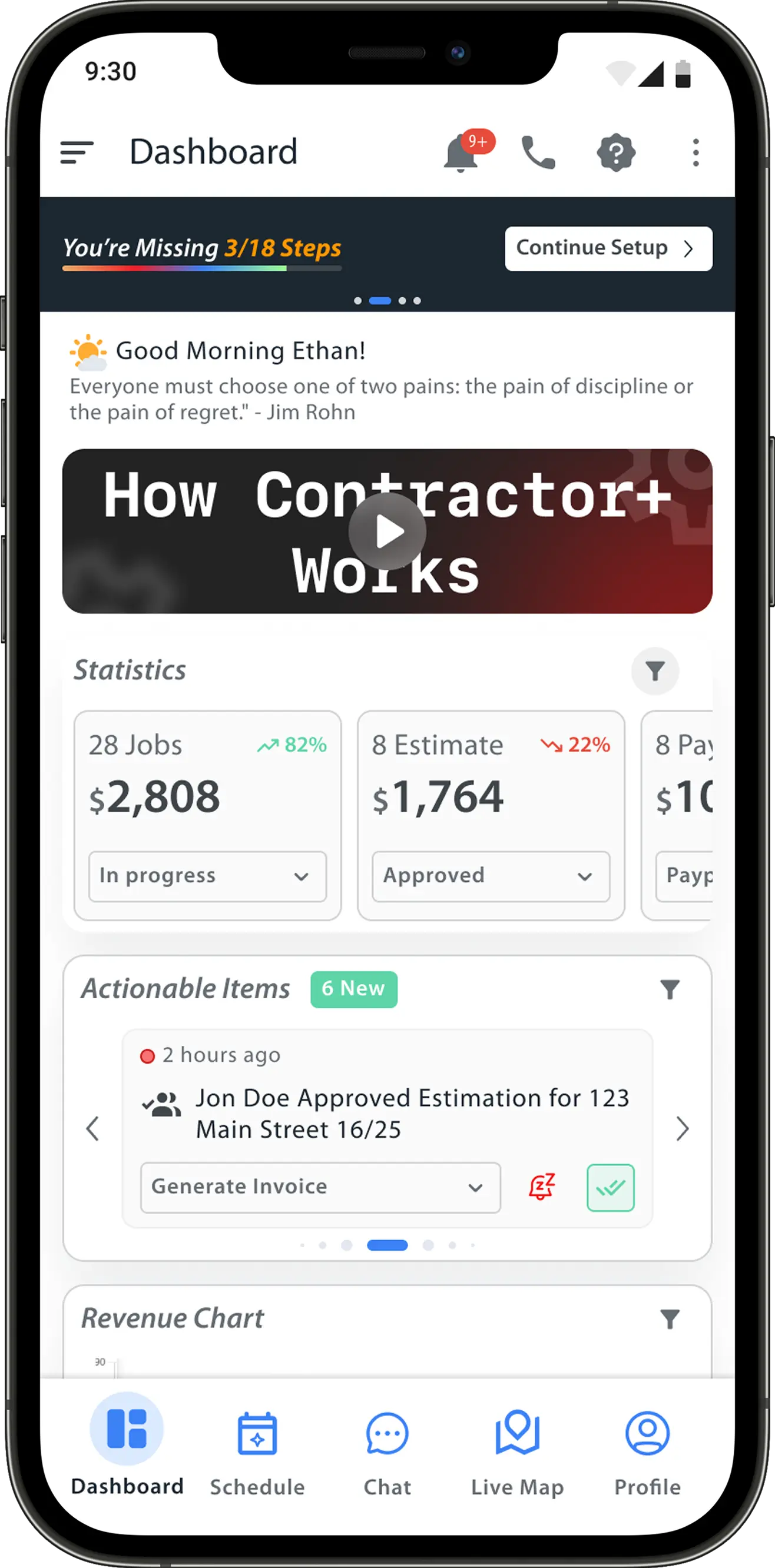

The first Operating System for build & service contractors

Contractor+ is the category disruptor the $1T field service market has needed. We’ve built what Jobber, Housecall Pro, and ServiceTitan couldn’t: a platform contractors actually love.

And we’ve done it without a cent from VC’s.

The problem

Contractors are still running modern businesses on outdated, overpriced, and fragmented software stacks. They’re duct-taping together 5–10 tools just to manage jobs, crews, scheduling, payments, and communication.

The result?

Poor Communication

High Costs

*The industry incumbents aren’t fixing it — they ARE the problem.

Mid-Market

(Jobber, HCP, Joist)

Enterprise

ServiceTitan, Procore, etc.

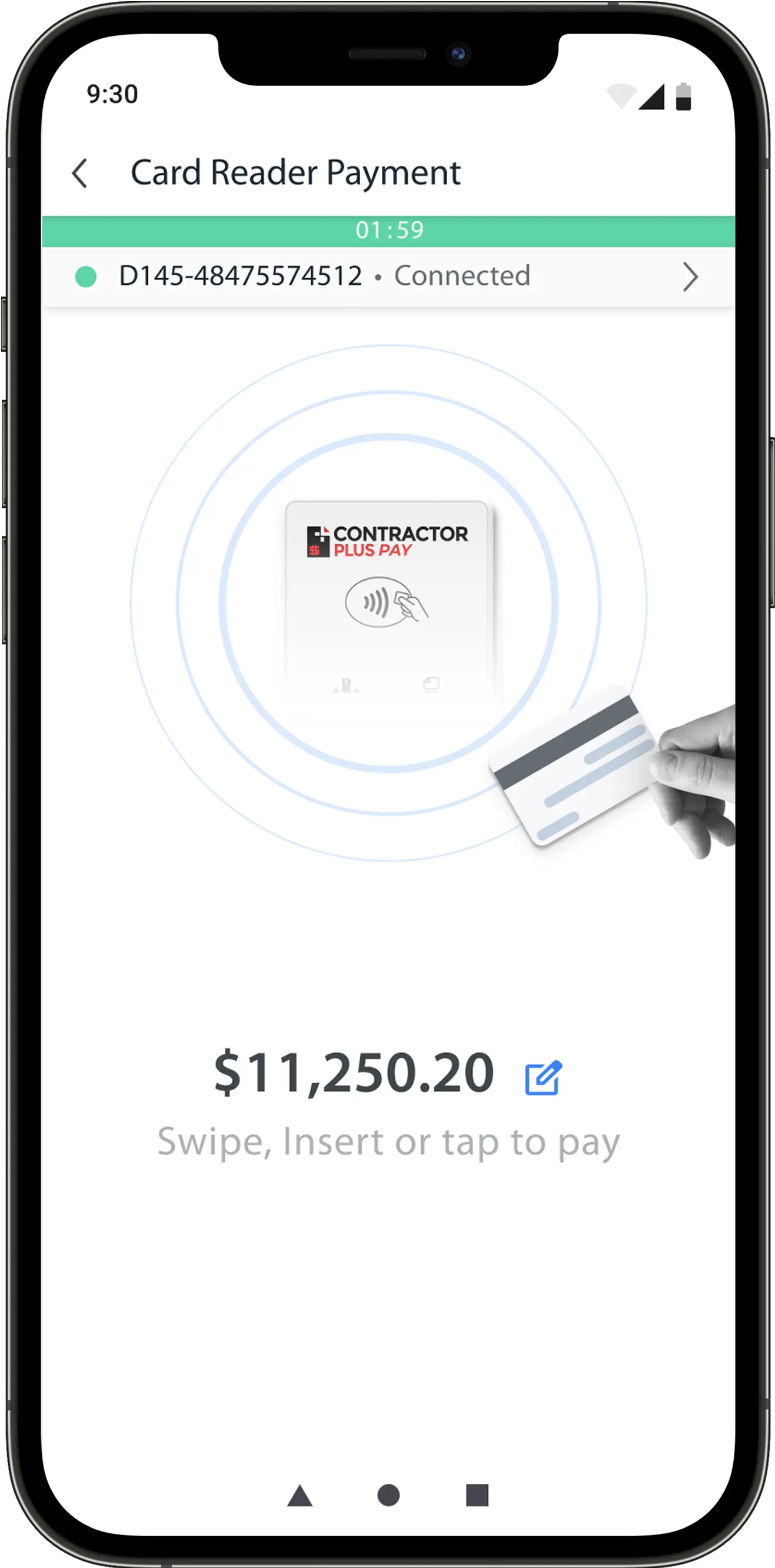

One connected platform

Built mobile-first

Onboard quickly

Instant Sync

Full access is $98/month

Why now?

Field service is in the middle of a generational software shift.

Labor and material costs are rising, businesses need to run as efficiently and effectively as possible

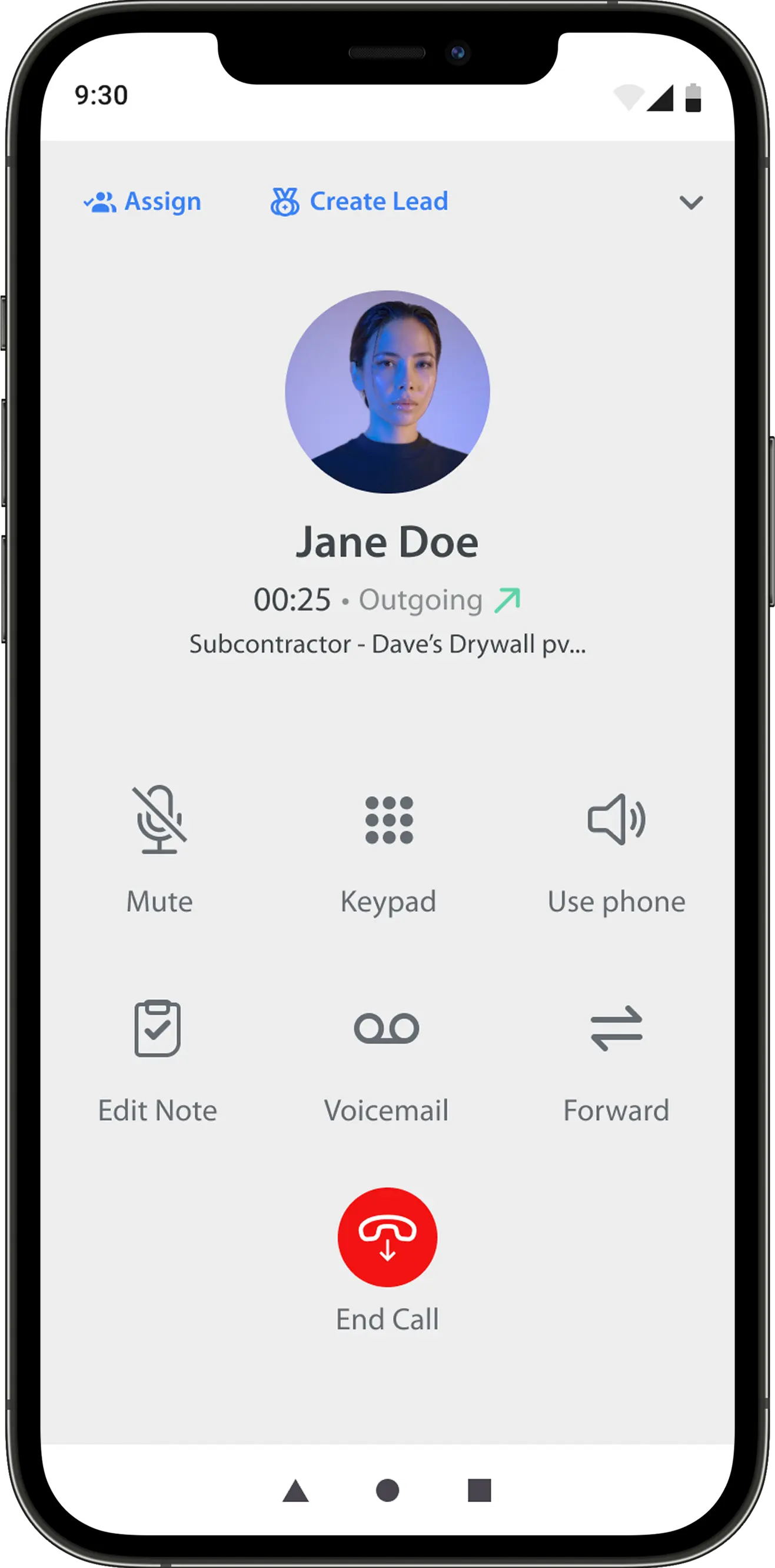

Customers demand speed in work and communication from contractors

AI is changing how contractors communicate, quote, schedule, and manage jobs

Smartphone-first crews are demanding tools that actually work in the field

The industry's dominant players have gotten too big, slow, and expensive to keep up.

Why Contractor+?

We're the first and only OS for contractors. A connected system that moves as one cohesive engine to run the entire business. Contractor+ removes every point of friction in the operation by automating the tasks, handoffs, and updates that usually slip through the cracks. It's not a collection of point solutions, but one solution synced between each module.

Proof it's working

This isn't another FSM software. We built something contractors use, love, and stick with.

$1M+ ARR

With zero institutional capital

~6%

of freemium users organically convert to a paid plan

94%

Gross retention

4.7★

Avg rating across Capterra, G2, Apple, and Google Play

$700K

All built with just $700K from angels and Reg CF

~150%

YoY growth

Now imagine what we'll do with

real capital.

Market opportunity

The U.S. contractor software market is MASSIVE, and underserved.

→ ServiceTitan just IPO’d at $101/share. Housecall Pro and Jobber are sitting on $100M+ ARR.

And yet, contractors still hate their software. Have you ever met someone that raves about ServiceTitan? People learn to tolerate it because it’s all they’ve known. We’ve run and grown a successful contracting business ourselves. Owners are sick of software that is more painful than helpful.

Market opportunity

The U.S. contractor software market is MASSIVE, and underserved.

Our Serviceable Available Market focuses on the countries where Contractor+ can realistically operate today.

And yet, contractors still hate their software. i.e. regions where our required tech integrations (Contractor+ Payfor payments and Contractor+ Voice for telephony) are fully supported. These currently include United States, Canada,United Kingdom & Ireland, Australia, Japan, France & Spain.

Market opportunity

The U.S. contractor software market is MASSIVE, and underserved.

These developed markets represent a very large subset of the global TAM.

And yet, contractors still hate their software. In fact, they likely account for over half of the world’s home services activity by value (for example, the U.S. + Canada alone make up roughly 50–60% of the global market at ~$600B

Market opportunity

The U.S. contractor software market is MASSIVE, and underserved.

Our Serviceable Obtainable Market is the subset of contractors most likely to see value in our platform in the near term

And yet, contractors still hate their software.Essentially the early adopters and tech-forward firms within our SAM. A straightforward way to estimate this is by percent of contractors : for example, if even ~5% of the ~8 million serviceable contractors are actively seeking modern software solutions, that’s on the order of 400,000 potential Contractor+ users in the near-to-mid term.

What's next (GTM + fund use)

We've proven product-market fit. Now it's time to dominate.

We're raising $10M+ to launch a go-to-market blitz that floods the category

Tradeshow saturation

The biggest booth. The loudest keynote. The best closers on the floor.

Full-funnel paid media

Retargeting, YouTube, Meta, Google, TikTok, influencer UGC.

Full-funnel paid media

Retargeting, YouTube, Meta, Google, TikTok, influencer UGC.

10x our investment into sales & support

Build the team who knows how to get the bag and keep it.

Customer-led content engine

Podcast, testimonials, UGC, success stories weekly.

ASO + SEO + Lead Gen acceleration

We already rank. Now we'll scale it.

Ambassadors, associations & integration partners

CAC drops, reach explodes.

Why this team wins

Founders are 100% all-in. No chips off the table.

Built a category-defining product with just $700K.

Board includes operators with two $100M+ software exits.

We’re not here to coast. We’re here to eat the legacy players’ lunch.

Obsessed with the customer. Fast to ship. Brutal on churn.

Smart money sees what’s coming

And it’s going to be big. If anything you’ve read resonates, let’s talk.

Disclaimer: This offering is made pursuant to exemptions under Regulation D and Regulation Crowdfunding (Reg CF) of the U.S. Securities Act of 1933. Securities are not registered, may be illiquid and involve risk. For Reg D offerings, only accredited investors may participate (or a limited number of sophisticated investors if under Rule 506(b)). For Reg CF, investments are made through an SEC-registered intermediary and are subject to contribution limits and resale restrictions. Nothing herein constitutes legal, tax, or investment advice. Please consult your own advisors before investing.